What Does The Bank of England’s Delayed Rate Cut Imply For US?

25% on Thursday (June 20), despite a return of UK inflation to the central bank’s 2% target in May, reported the day before…It’s also striking that UK inflation is well below the equivalent for the US… Indeed, despite a clear sign that UK inflation has returned to target, the central bank …

If the Bank of England’s decision on Thursday to leave interest rates unchanged is a guide, the outlook for the start date for a US rate cut may be further down the line than generally assumed.

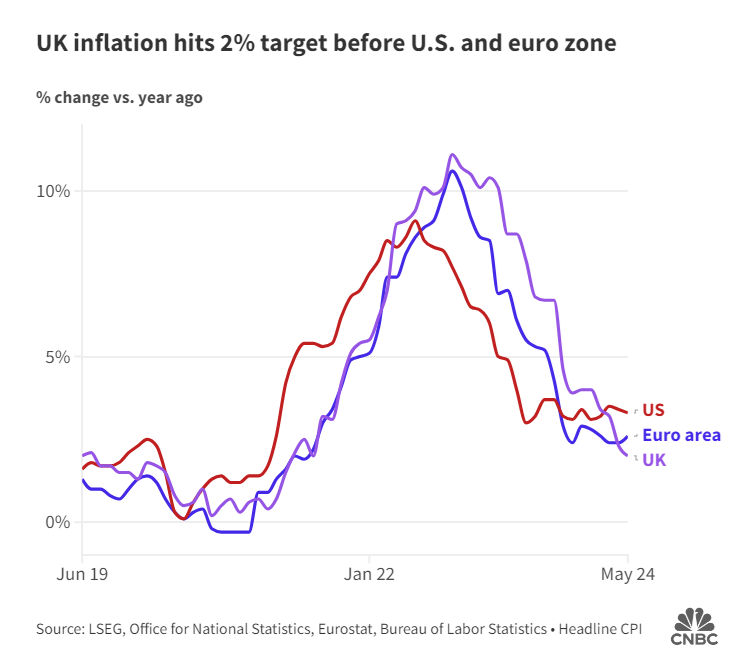

There are many differences between the UK and US economy and so sizing up BoE policy decisions with the Federal Reserve is an apples and oranges comparison on several fronts. Yet it’s hard to overlook the fact that the Old Lady of Threadneedle Street left its target rate unchanged, at 5.25% on Thursday (June 20), despite a return of UK inflation to the central bank’s 2% target in May, reported the day before.

It’s also striking that UK inflation is well below the equivalent for the US. Naively extrapolating the difference as a guide to the future suggests that the Fed’s rate cut is nowhere on the near-term horizon – a guesstimate that contrasts with market expectations in the US.

But England isn’t America and the crowd evaluates the macro outlook quite differently for the US, and rightly so. Nonetheless, there’s still room for debate on guesstimates on timing for the first Fed rate cut. Fed funds futures are currently estimating an implied 66% probability that the Sep. 18 FOMC meeting will mark the first announcement of policy easing. The obvious caveat: US investors have been pricing in moderate odds for rate cuts for much of the past year, only to be disabused of that forecast, time and time again.

Is this time different? No one knows, but the BoE’s decision surely offers another reason to stay cautious on expecting US rate cuts will arrive sooner rather than later. Indeed, despite a clear sign that UK inflation has returned to target, the central bank remains reluctant to embrace a dovish pivot.

“It’s good news that inflation has returned to our 2 per cent target,” notes Andrew Bailey, BoE’s governor. “We need to be sure that inflation will stay low and that’s why we’ve decided to hold rates at 5.25 per cent for now.”

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

The key question: Will the Fed be similarly cautious? At least one voting member of the FOMC is leaning in that direction. Thomas Barkin, president of the Federal Reserve Bank of Richmond, told reporters yesterday: “My personal view is let’s get more conviction before moving.”

At a high level, the case for standing pat looks much stronger for the Fed vs. BoE given that US inflation – at 3%-plus – is still well above the 2% target.

CapitalSpectator.com’s ensemble forecasting model for core CPI suggests that sticky inflation risk will continue to fade, but slowly, and so the case for rate cuts based on this forecast still looks muddled.

Federal Reserve Governor Adriana Kugler, however, threw out some mildly dovish comments on Tuesday to keep hope alive for 2024:

“While I remain cautiously optimistic that inflation is coming down, it is still too high, and it is moving down only slowly. I believe that policy has more work to do [but] if the economy evolves as I am expecting, it will likely become appropriate to begin easing policy sometime later this year.”

Author: James Picerno