Will Commodities Continue To Outperform In 2024?

In December I wondered if commodities were poised to be the contrarian trade of 2024… Four months later, there’s no competition across the major asset classes: commodities are the upside outlier by a wide margin, based on a set of ETFs through Friday’s close (Apr… What’s the catalyst fo…

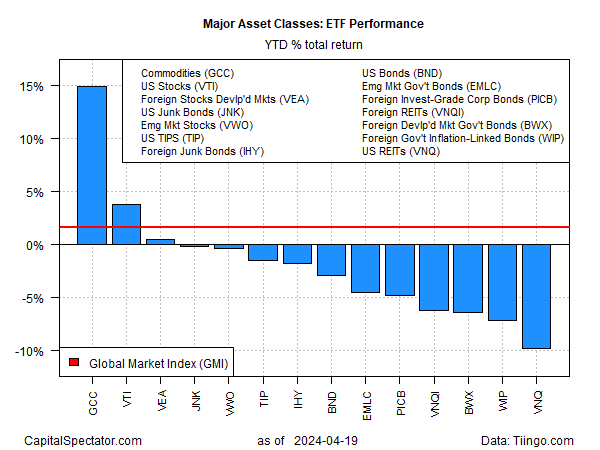

In December I wondered if commodities were poised to be the contrarian trade of 2024. Four months later, there’s no competition across the major asset classes: commodities are the upside outlier by a wide margin, based on a set of ETFs through Friday’s close (Apr. 19).

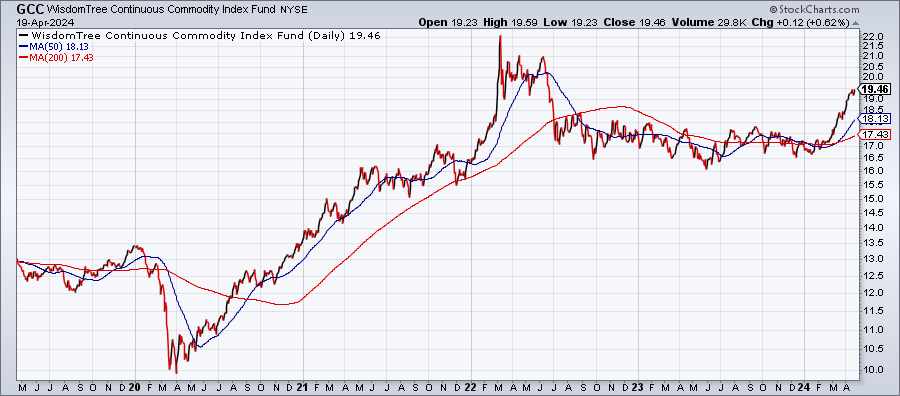

WisdomTree Enhanced Commodity Strategy Fund (GCC) is up nearly 15% year to date. The second-best performer in 2024 is the fast-deflating US stock market (VTI), which ended last week with a 3.7% rise.

The other main takeaway in the chart above: most of the major asset classes are in the red so far this year. The deepest loss is in US property shares (VNQ) via 9.8% decline for 2024.

What’s the catalyst for the rise in commodities prices? “The world economy started growing again,” says Jan van Eck, CEO of VanEck, a fund company. He cites China as a factor. “China which has been such a huge driver of growth and so negative for growth over the last year or two. Manufacturing PMI is now positive in China as of March,” he observes. “You now have growth. … So, that leads to your reflation trade.”

A widely followed marker in the commodities rally is this year’s rise in gold. SPDR Gold Shares ETF (GLD) is up 15.6% year to date. A key factor is the recent rise in demand from central banks for the precious metal, China in particular. Business Insider reports:

“The People’s Bank of China, or PBOC, has been snapping up gold for 17 straight months, with its holdings of the precious metal rising 16% over this period, according to a report from the international trade association World Gold Council. This buying spree coincides with a trend among central banks globally to diversify their holdings to reduce their reliance on the US dollar.”

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Keep in mind that while commodities are the year’s big winner, there’s still room for debate on whether the latest move is more than a bounce within a trading range. Using GCC as a benchmark, the commodities rally has lifted prices from roughly two years of flatlining near the low end of a range.

Impressive, but the jury’s still out on whether the recent run is more than a technical bounce that leaves prices churning below 2022’s peak, which was an initial reaction to Russia’s invasion of Ukraine — a reaction that the crowd subsequently revised with a less dire supply/demand estimate.

No one knows how current conditions will play out vis a vis commodities, but there are key questions to ponder. That includes wondering what catalysts would continue to drive commodities prices higher from current levels?

Commodities bulls cite sticky inflation as a factor. Perhaps, but keep in mind that if disinflation has faded – or if reflation is becoming more likely – the Federal Reserve will likely delay rate cuts further out in time and perhaps even resume rate hikes, which could slow economic activity, which is presumably a key driver in this year’s commodities run. Meanwhile, higher yielding government bonds will become even more attractive as an alternative to zero-yielding commodities.

Then again, it’s premature to dismiss the upside price momentum that dominates the commodities profile at the moment. But this much is clear: the contrarian trade idea that animated the commodities outlook several months ago is no longer relevant. A bullish outlook for this asset class requires a different set of analytics, which is considerably more complicated than the relatively simple December view that commodities were an intriguing contrarian trade.

Author: James Picerno