Will Tariff-Related Inflation Derail The Bond Market’s Rally?

Whatever the outcome, the results will affect inflation, monetary policy and, by extension, the bond market…The outlook for bonds will likely be driven by how the tariff-related inflation plays out in the months ahead… The same is likely to be true of the economic effects, which will includ…

Rising US bond prices have offset the slide in US equities so far this year, but the outlook for fixed income may be more precarious than the current rear-window perspective suggests.

President Donald Trump put most of his tariffs on a 90-day pause and so the immediate effects of higher import prices have been curtailed to a degree. The question is whether the reprieve is temporary? Much depends on the success of the administration’s efforts to craft trade deals over the next several months. Whatever the outcome, the results will affect inflation, monetary policy and, by extension, the bond market.

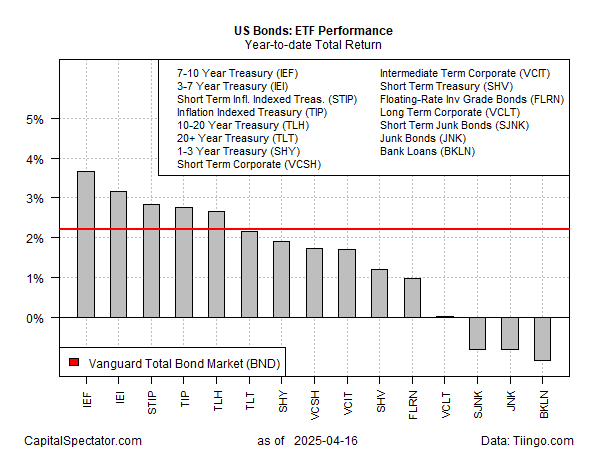

Deciding what’s likely to unfold is unusually challenging at the moment because Trump’s agenda and decision-making process is a moving target and opaque to most outsiders. Meanwhile, the bond market is holding on to modest gains so far this year, offering diversification benefits to losses in stocks, based on a set of ETFs through Wednesday’s close (Apr. 16). The strongest performer: medium-term Treasuries (IEF), with a 3.7% year-to-date gain. That’s a handsome premium over the US investment-grade bond benchmark (BND), which is up 2.2% in 2025.

The losers this year for bonds are limited to lower-rated securities, led by Invesco Senior Loan ETF (BKLN), which has shed 1.1% in 2025.

The outlook for bonds will likely be driven by how the tariff-related inflation plays out in the months ahead. Fed Chairman Powell offered some clues on the central bank’s current thinking. Speaking yesterday at the Economic Club of Chicago, he said:

The level of the tariff increases announced so far is significantly larger than anticipated. The same is likely to be true of the economic effects, which will include higher inflation and slower growth. Both survey- and market-based measures of near-term inflation expectations have moved up significantly, with survey participants pointing to tariffs. Survey measures of longer-term inflation expectations, for the most part, appear to remain well anchored; market-based breakevens continue to run close to 2 percent.

No change in monetary policy is expected at the moment, he added. “For the time being, we are well positioned to wait for greater clarity before considering any adjustments to our policy stance.”

The policy-sensitive US 2-year Treasury yield continues to trade near its lowest level in recent months, well below the current Fed funds target rate range (4.25%-4.50%) — a setup that suggests the market is still expecting a rate cut in the near future.

Fed funds futures this morning, however, are confident that no change is likely for the upcoming May 7 FOMC meeting. The June meeting, by contrast, is pricing in a 70% probability for a rate cut.

Fed Governor Chris Waller on Monday said that any inflation increase triggered by tariffs may be temporary because of slower growth and higher unemployment related to higher import fees. In that scenario, “The preemptive policy cuts we did last fall can allow us some time to wait and see if the hard data catch up to the soft data or vice versa and how much of the tariff will be passed through to the consumer,” he explained.

How this all plays out is anyone’s guess at this point. Meantime, the only sure thing is that the key variable resides in the mind of the man in the Oval Office.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Author: James Picerno